ECON 101 - Intro to Microeconomics

TTH 2:30PM - 3:50PM

SJ2 1004

Lutz Busch (?)

1 | Four Core Principles

Four Economic Principles

- Cost-benefit principle

- Opportunity cost principle

- Marginal principle

- Interdependence principle

Rational Rule = individuals always make decisions that provide them with the highest amount of personal utility (maximizing profit)

2 | Demand

Law of Demand: Demand decreases as price decreases

- Ceteris Paribus: holding all else equal

- Marginal Principle: only do something if Marginal Benefit > Marginal Cost

- Diminishing marginal benefit of consumption= more gas in same tank has less marginal utility

- Market Demand: demand for everyone

Shifting the Demand curve

- Income

- Normal good = demand increases with more income

- Inferior good = demand decreases with more income

- Tastes and Preferences

- Price of related goods

- Complimentary good = direct correlation

- Substitute good = inverse correlation

- Expectations

- Congesting and Network effects

- Network effect = demand increases as users increase

- Congestion effect = demand decreases as users decrease

- Type and number of buyers in the market

- Shifts the market demand curve, not the individual one

3 | Supply

Law of Supply = Supply increases as price increases

Perfect Competition:

- all firms in the market are selling an identical product

- many buyers and sellers (each small relative to the overall size of the market) and no barriers to entry/exit

- perfect information

- zero mobility costs (costs nothing to switch from one seller to another)

Diminishing marginal product = more workers with the same supplies have less marginal production

Marginal cost of production includes variable and fixed costs

Shifting the supply curve

- Input prices

- Productivity and Technology

- Prices of related outputs

- Substitutes-in-production

- Compliments-in-production

- Expectations

- Type and number of sellers

4 | Equilibrium

Market economy vs planned economy:

- Market economy = people make their own choices about what to produce and consume in markets

- Planned economy = decisions about production and distribution are centralized

Market = setting that brings together buyers and sellers to engage in transactions

- Most of them use a price to adjust supply and demand

- Some don’t (votes, dating, grades, PR)

Equilibrium = when supply meets demand

- Surplus = quantity supplied > quantity demanded (lower prices)

- Shortage = quantity supplied < quantity demanded (higher prices)

Out-of-equilibrium markets

- Unusual price changes

- Queuing

- Secondary markets

Diamond-water paradox

- Water is essential (low price), diamonds are decorative (high price)

- Because of diminishing marginal benefit

5 | Elasticity

Price Elasticity of Demand = how responsive buyers are to price changes

- Inelastic: elasticity <1

- Elastic: elasticity >1

- Unit elastic demand: elasticity = 1

Determinants of demand price elasticity (ability to find close substitutes)

- More competing products means greater price elasticity

- Specific brands are more price elastic than categories of goods

- The demand for necessities is less price elastic

- Consumer search makes demand more price elastic

- Demand gets more price elastic over time

Total revenue of firm

Cross-price Elasticity of demand

- substitutes: >0

- compliments: <0

- independent goods: =0

Income elasticity of demand

- normal good: >=0

- inferior good: <0

Price elasticity of supply:

-

1: supply is price elastic

- <1: supply is price inelastic

Determinants of of supply price elasticity (how flexible is production?)

- Output can easily be stored as inventory

- Variable inputs can easily be adjusted

- Fixed inputs are not being fully utilized so there is excess capacity

- Low barriers to entry and exit of producers in the market

- More time is allowed to pass since then all inputs can be adjusted

6 | Taxes, Price Controls, Quantity Regulations

Taxes on buyers

- Reduces consumer’s marginal benefit by the amount of the tax

- Statutory Burden (who is legally responsible for paying tax) vs Economic burden (who bears the cost of the tax)

- Tax Incidence = how much of the burden falls on buyers vs sellers

Taxes on sellers

- Increases marginal cost to sellers

Tax Wedge

- Economic burden is independent of statutory burden

- Tax wedge = point along the x (quantity) axis where vertical distance between demand and supply is equal to the tax

Tax incidence and price elasticity

- If supply is more price elastic than demand, economic burden falls on buyers

- Otherwise, it falls on sellers

Subsidies

- Like a negative tax: shifts the market demand curve up

Price ceilings / floors

- When it falls below the free-market equilibrium price, it is binding

- Leads to shortages because nobody produces

Quotas

- Maximum / minimum quantity regulations

7 | Welfare Economics: Evaluating Market Efficiency and Market Failure

Positive vs Normative policy analysis

- Positive: What would happen if a policy was adopted

- Normative: Should a policy be adopted? Value judgements

Efficiency vs Equity: How does people’s welfare change

- Economic surplus = benefits - costs

- Economically efficient = more economic surplus for everyone

- Efficient outcome = largest possible economic surplus

- Economic equality = making everyone better off

Consumer Surplus

- Marginal principle: buyers earn surplus on all purchases except the last

Producer Surplus

- Marginal principle = producers earn surplus on all sells except the last

Voluntary exchange and gains from trade

Efficient things

- Efficient production: Quantity of output produced is at lowest possible costs

- Efficient allocation: Output produced is allocated to consumers and maximizes total consumer surplus

- Efficient quantity: Quantity of output produces the largest possible economic surplus

- Rational rule for markets = produce more if marginal benefit > marginal cost

- Competitive markets are efficient

Market Failures: Market isn’t perfectly competitive and market equilibrium is inefficient

- Market power

- Barriers to entry → producers charge higher prices → output falls below efficient quantity

- Externalities

- Buyers and sellers make inefficient choices

- Imperfect information

- Buyers and sellers have private information → trades with mutual gains aren’t made

- Irrationality

- Buyers and sellers don’t follow rational rule

- Government regulation

Deadweight Loss (DWL)

- From underproduction: Economic surplus @ efficient quantity - @ actual quantity

- From overproduction: Production @ actual quantity - @ efficient quantity

Market Failure vs Government failure

- Market failures: Interventions include taxes on alcohol/cigs, subsidies on COVID/flu vaccines, food safety standards, carbon taxes on gas

- Government failure: Could happen if politicians try to improve re-election chances by appeasing special interest groups

Equity Criterion

- Rawls: Veil of ignorance cares more about the poorest person

- Bigger share of smaller pie < Smaller share of bigger pie

8 | Gains from Trade and Comparative Advantage

Gains from trades = “win-win” produced from transactions between buyers and sellers

- Barter economy: coincidence of wants, money is NOT a medium of exchange

Advantages

- Absolute advantage

- Comparative advantage → Specialization

Examples

- My dentist is better at cleaning my teeth than my dental hygienist. Why doesn’t my dentist clean my teeth?

- It takes me less time to rake the leaves at our house than it takes my son. Why should he do it?

- Nobody is better at cleaning my house than me, but I pay someone else to do it. Why?

- The goalie on my men’s hockey team would be the highest scorer on our team if he played center. Why does he play goalie?

- Should the Department Chair of the Economics Department at the University of Waterloo be the person with the best management and leadership skills?

International trade

- autarky = no trade

Incentivizing specialization

- Roomba and Goodfood reduce the opportunity cost of working extra hours outside the house

- Do more of what you’re relatively good at

Internal markets allocate resources within organizations

- North and South Korea are so different because of markets

- Internal markets overcome the knowledge problem when making efficient decisions-

10 | Externalities and Public Goods

Externality = unconsidered side effect, can be negative / positive

External costs

- Sellers consider marginal private cost

- Marginal external cost imposed on bystanders

- Marginal social cost of production matters to society

External benefits

- Buyers consider marginal private benefit

- Marginal external benefit

- Marginal social benefit

Social optimal outcome

- Rational rule for society: Marginal social benefit marginal social cost

Negative externalities lead to overproduction (eg. producing too much gasoline) Positive externalities lead to underproduction (eg. producing not enough flu shots)

Externality problem = private decision makers ignore the well-being of bystanders

- Private bargaining: Side payment eliminates the externality

- Coase Theorem = externality problem can be solved if bargaining is costless

- If the right to play loud music belongs to the individual playing the music, the bystander should be willing to pay up to the amount of the marginal external cost to avoid the loud music.

- Corrective taxes and subsidies

- Induce people to take account of their negative externalities

- Trudeau tried a carbon tax but it was repealed

- Cap and trade

- Set quotas

- Give producers a fixed number of permits (eg. carbon cap system)

- Laws, rules, regulations

- Government provision

- Club goods = nonrival but excludable (private gyms, streaming services)

- Assigning ownership rights

- Tragedy of the commons

Nonexcludable and nonrival goods

- Nonexcludable = people cannot be kept from enjoying the benefit of a good I purchase

- Mines, fisheries, forests

- Nonrival good = my use of a good doesn’t subtract from the benefit other people get from it

- Cable TV, private parks, cinemas

- Public good = both

- National defense, air, sunshine

- Free-rider problem

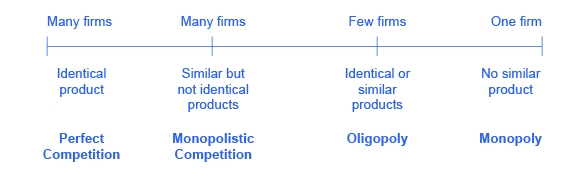

14 | Market Structure and Degrees of Market Power

Industrial organization = economic field of research examining how business (“firms”) are organized within markets and how their structure affects the competitiveness of the market Market structure = important in determining to what extent a seller can charger higher prices without losing sales to competing businesses Market power = when you can raise prices with little to no change in sales. There is none in a perfectly competitive market Perfect competition assumes

- All businesses sell an identical product

- Many buyers and sellers comprise a small share of the market

Monopoly = market with one seller (greatest possible market power), implies imperfect competition Oligopoly = market with a small number of large sellers (eg. telecom in Canada) Product differentiation = business strategy

Firm’s demand curve = quantity that buyers demand from VS price charged

- In a perfectly competitive market, demand curve is inelastic (horizontal) because any price increase means losing all customers

- Since a monopolist is the only seller of product in a market, the demand curve for their product is the same as the market demand curve

- With imperfect competition, businesses with more market power can raise prices higher, meaning their demand curve is closer to the market demand curve

Firm’s marginal revenue curve = addition to total revenue from selling one more unit

- Marginal revenue = Output effect of price change minus discount effect of price change

- To increase sales, the firm must lower prices of all units sold, not just the marginal unit

- The marginal revenue of an increase in quantity is always less than the price

- Discount effect is bigger when sales are higher because a price reduction affects more units being sold

Rational rule for sellers = sell one more unit if marginal revenue > marginal cost

- A perfectly competitive firm follows this rule

Consequences of market power

- Price in an imperfectly competitive market > price in a perfectly competitive market

- Quantity in an imperfectly competitive market > quantity in a perfectly competitive market

- A form with market power earns a healthy profit margin

- profit margin = price - average cost

Competition policy (antitrust policy) are regulations designed to ensure markets remain competitive

- Anti-collusion laws

- Merger laws

- Exclusionary practices (suppliers can’t sell to competitors) and predatory pricing practices (lowering prices temporarily to force competitors out) ARE ILLEGAL

Policies to mitigate harm from market power

- Price ceilings

- Public provision in markets with natural monopolies

- Natural monopolies = market with high fixed operating costs, so a natural monopoly is cheapest

15 | Entry, Exit, and Long-Run Profitability

Types of Profit

- Accounting profit = total sales revenue - explicit financial costs

- Economic profit = total sales revenue - explicit financial costs - IMPLICIT OPPORUTNITY COSTS

Average revenue = revenue per unit supplied Average cost = cost per unit supplied (includes fixed and variable costs)

Profit margin = average revenue - average cost

- Also equal to profit margin - # units sold

- Businesses try to maximize profit, not profit margin

Short-run horizon = when the business’s only objective is to outcompete existing rivals Long-run horizon = competitors can enter/expand, existing competitors can contract/exit

Rational Rule for Entry = enter a market if expected economic profits are positive

Free entry pushes economic profits to 0

- No factors keeps new businesses from entering the market

- Extra competition drives down everyone’s profit

- If firms are still earning profit, more firms enter

- This drives down everyone’s profit until it reaches 0

Rational Rule for Exit = exit a market if expected economic profits are negative

Free exit ensures industries are not unprofitable in the long run

- No barriers keeping businesses from shutting down / switching markets

- Fewer competitors increases profit of remaining businesses

- If the market is still unprofitable, more business leave

- Enough businesses leave for the remaining ones to become profitable

Price equals average cost (in the long-run equilibrium in a market with no barriers to entry) Perfect competition drives price down to marginal cost

Barriers to entry

- Create customer lock-in

- Customers have switching costs as a result of customer loyalty and network effects

- Develop cost advantages

- Learning by doing leads to efficiency gains in established forms

- Mass production leads to low average costs

- Research and Development (R&D) gives incumbents cheaper methods

- Influence government policy

- Patents provide the inventor of a new product with exclusive right to it

- Some markets require a license to operate (banks, transportation, cannabis, restaurants)

- Corporate lobbyists may persuade politicians to increase market regulations (health and safety) to impose costs on potential competitors

- Entry deterrence strategies

- Invest in excess capacity to allow you to produce at lower marginal cost

- Keep “cash in hand” rather than investing profits / returning to shareholders

- Saturate market with brands (eg. breakfast cereals) to deter new niche brands

- Build a reputation as a fierce competitor

16 | Price Discrimination

Market power outcome if one price

- A business with market power will supply until their marginal cost of production is equal to their marginal revenue

One price outcome

- Business with market power can drive the price above its marginal cost and capture part of the consumers’ surplus

- Sellers get more surplus than consumers and there is deadweight loss

- But business with market power will want more

Price discrimination

- Businesses sell the same good at different prices

- Reservation Price = the max price a consumer will pay for something

- Perfect price discrimination = market outcome where each customer is charged their reservation price

- Solves the underproduction problem at the cost of consumer welfare

How to target prices to the right customers

- Group pricing: use identifiable characteristics (eg. children’s prices, senior’s discounts, men’s haircuts, ladies’ night at clubs)

- Hurdle prices: offer lower prices to buyers willing to overcome a hurdle (early book releases, red-eye flights, clearance at the back of a store, haggling prices, coupon booklets, premiere seats for movies, 2-for-1 pizzas, international tuition for universities because they want Canadian PR status)