AFM 191 - Foundations of Financial Reporting

W 10 - 11:20AM

AL105

Cody Buchenauer

1 | Intro to Accounting

1.1 | Accounting is the language of business

Accounting Standards

- General Accepted Accounting Principles (GAAP)

- Accounting Standards for Private Enterprise (ASPE) - Private

- International Financial Reporting Standards (IFRS) - Public or Private

- Accounting Standards Board (AcSB)

Why standards?

- Understandability

- Relevance

- Reliability

- Comparability

Assumptions of External Financial Reporting

- Going Concern Assumption: Company will continue to operate in future years

- Separate Entity Assumption: Transactions that occur in the company relate to the business it operates in

- Historical Cost Assumption: Business transactions are primarily recorded at cost

| Internal | External | |

|---|---|---|

| Level of detail | Detailed + Summary | Summary |

| Frequency | Monthly + Quarterly + Yearly | Quarterly + Yearly |

| Comparisons | Actual Result + Budget + Forecast + Prior Year | Actual Result + Prior Year |

1.2 | Intro to Financial Statements

| Financial Statement | Preparation Order | Period | Purpose | Basic Equation |

|---|---|---|---|---|

| Income statement a.k.a. Statement of profit and loss (P&L) | 1 | Prepared for specific period: month, quarter, or year | To understand a company’s profit or loss for a period | Total revenue - Total expenses = Net income |

| Statement of retained earnings | 2 | Prepared for specific period: month, quarter, or year | To understand the change in retained earnings for a period | Beginning retained earnings + Net income - Current period dividends = Ending retained earnings |

| Balance Sheet a.k.a. Statement of financial position | 3 | Balances as at a point in time | To understand the financial position at a particular point in time | Assets = Liabilities + Shareholder’s Equity |

| Cash Flow Statement | 4 | Prepared for specific period: month, quarter, or year | To understand sources and use of cash during a period | Operating cash flows + Investing cash flows + Financing cash flows = Net increase (or decrease) in cash for a period + Cash balance at beginning of period = Cash balance at end of period |

| Income Statement |

- Service Revenue = Revenues from selling services

- Sales Revenue = Revenues from selling goods

- Interest Revenue = Revenues from lending on credit

- Rent Revenue = Revenues from rent

Statement of Retained Earnings

- Retained Earnings + Net income - Dividends paid

Balance Sheet

- Assets = What the company owns (cash, inventory, capital)

- Liabilities = What the company owes (payable accounts, debt, bonds)

- Basic Accounting Equation: Shareholder’s Equity = Assets - Liabilities

Cash Flow Statement

- Operating Activities = Revenue producing activities related to core business

- Investing Activities = Business activities relating to investing

- Financing Activities = Business activities related to raising capital

Financial Statements as a System

1.3 | Private vs Public Companies

Private Shareholders might include

- Founders

- Angel investors

- VC firms

- PE firms

Differences

- Private chooses between ASPE and IFRS, Public follows IFRS

- Private companies cannot be listed, public companies can

- Private companies don’t have public information, public companies do

- Private companies can choose to have a BOD (Board of Directors), public companies must

Similarities

- Both can borrow money from a bank

- Both can issue bonds (more common for public)

- Both report internally

- Both report externally

Tutorial 1

Requirement 2:

- Private, not publicly listed

- Accounting Standards for Private Enterprise (ASPE)

- get a bank loan, making internal decisions, compare with other companies

- Internal - they have a 40% stake

Requirement 3:

- Income statement (profit/loss), Balance Sheet (financial position in time), Cash flow statement (use of cash)

- Monthly, Quarterly, Annually

- Understandability, Relevance, Reliability, Comparability

- Less frequent / less detailed / No comparison to forecast or budget

Requirement 4

- VC / PE firms

2 | Accounting Fundamentals

2.0 | Accounting Fundamentals

A - Assets

L - Liabilities

SE - Shareholders’ Equity

R - Revenue

E - Expense

2.1 | Source Documents and Capturing Transactions

How transactions begin

- Cradle to Grave = start (source document) to finish (giving or receiving cash)

- Source Documents = key details of a business transaction

- Invoice = request for payment

How transactions are captured

- Accounting Information System (AIS) = the books

- Transactions and Accounting Data → AIS → Financial Statements

- Journal Entry = record of a transaction or accounting event

2.2 | Organizing Data and Generating Reports

How Transactions are Stored and Organized

- DR. Cash = Debit Cash

- Debit = incoming money

- Credit = outgoing money

- Account = keeps track of all similar transactions

- On Account = purchase was made to day, will be paid later

- Chart of Accounts (COA) = compiled record of all accounts used by a business

- Temporary Accounts = “zeroed out” at the end of the fiscal year

- Permanent Accounts = balances carry forward

- General Ledger (G/L) = stores all transactions / journal entries in an account

- Subledger = subset of G/L

How Accounting Information is Reported

- Trial Balance (T/B) = point in time summary of all balances of every general ledger account

- All temp accounts start at 0 at the beginning of the fiscal year

- Balances for accounts on the balance sheet will be “as at” the date of the trial balance; income statement accounts will have cumulative balances “for the period”

- T/B is used for Internal and External, but mainly as a stepping stone

2.3 | Accrual Accounting and the Double-Entry System

Cash vs Accrual Accounting

- Cash accounting / Cash basis accounting = method of recognizing economic activity when cash is exchanged

- Accrual accounting = method of recognizing economic activity when revenue is earned and when expenses are incurred

- Matching principle = expenses must be recognized in the same period that the related revenue was earned

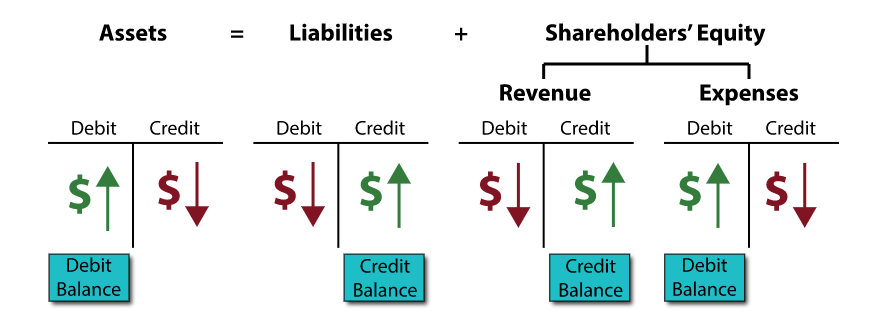

The Accounting Equation and Double-Entry Accounting

- Accounting Equation: Assets = Liabilities + Equity

- Double-entry accounting = every entry must have at least one debit and one credit

- Asset Account: Debt UP, Credit DOWN

- Liability Account: Debt DOWN, Credit UP

- Revenue Account: Debt DOWN, Credit UP

- Expense Account: DEBT UP, Credit DOWN

- Equity Account: Debt DOWN, Credit UP

Connecting the Accounting Equation with Account Balances

Connecting the Accounting Equation with Account Balances

- How to increase an account balance:

- Increase cash: debit it

- Increase expense: debit it

- Increase revenue: credit it

3 | Purchasing and Financing Business Assets

3.1 | Accounting for tangible long-term assets

- ASPE defines an asset as an “economic resource controlled by an entity as a result of past transactions or events and from which future economic benefits may be obtained.”

- Asset = a resource, controlled by a company that will help the company obtain future economic benefits (e.g., revenue or cash flows).

- It represents a future benefit that contributes directly or indirectly to future cash flows;

- The company can control access to the benefit; and

- The transaction or event which provides the company with control of the benefit has already occurred.

- Expense = things the company spends money on in the normal course of business which don’t explicitly contribute to future benefits

- Current assets = economic resources that will be sold or used by a company within 12 months of the reporting period

- Cash, accounts receivable, inventory = current assets

- Long-term assets = assets that will be used over multiple years

- Tangible long-term asserts (Property, Plant, and Equipment or PP&E = long-term physical assets to generate revenue, for admin, or PP&E

Recording an Asset Purchase Transaction

DR. Furniture and fixtures (A) 5,345

To record the purchase of chairs and tables.

The Concept of Depreciation

- Depreciation = accounting method which allocates the depreciable cost of an asset over the assert’s estimated useful life

- Also called amortization in COA, called “depreciation expense” or “amortization expense”

- Depreciable cost = total cost of an asset depreciated over the assets useful life LESS the estimated residual value of the asset.

- Estimated residual value = amount the company expects to receive when asset is sold

- Estimated useful life = Period in which an asset is expected to contribute directly / indirectly to future cash flows

- Contra Account = Account that reduces the balance of the account it’s associated with

- Accumulate Depreciation = Contra account to calculate the asset’s net book value in balance sheet

- Gain / Loss on assset disposal = account used to record the gains or losses from selling an asset

Depreciable cost = Total asset cost - Residual value

0 = Net Book Value - Residual value

Net Book Value (at end of useful life) = Residual value

Net Book Value (NBV) = Asset cost - Accumulated depreciation

| Depreciation Method | Definition | When it is used |

|---|---|---|

| Straight-line method | A method of depreciation which charges the cost of the asset to the income statement evenly throughout its useful life. | When long-term assets generate revenue evenly throughout their useful life. |

| Variable charge method | A method of depreciation which charges the cost of the asset to the income statement based on the usage of the asset. | When long-term assets wear out based on usage. |

| Decreasing charge method | A method of depreciation which charges the cost of the asset to the income statement based on higher initial charges that decrease over its useful life. | When long-term assets generate more revenue in the initial years, and less in the latter part of their useful life. |

| Straight-line depreciation = linear |

Variable charge method = Changes based on asset usage Decreasing charge method = Higher initial charges (more useful at the start, less at the end)

Tangible Long-Term Asset Complexities

- Changes to estimated useful life and/or estimated residual value

- Depreciation for partial periods

- Disposing or selling a tangible long-term asset before the end of its useful life

- Leasehold improvements

- When money is spent to make a rented tangible long-term asset useful

3.2 | Financing tangible long-term assets

How to Finance a Tangible Long-Term Asset

- Cash on hand (finance internally)

- Borrow money from a bank (debt financing)

- Raise money from private investors (equity financing)

Working Capital = cash for day to day operations

Debt Financing

- Line of Credit = borrowing money up to a certain limit, usually short term (12 months)

- Long-term loan = money lent by a bank to a company to purchase long term assets

- Interest / Interest rate

- Principal Payments / Interest Payments

Equity Financing

- exists

4 | Revenue and Accounts Receivable

4.1 | How do companies make money?

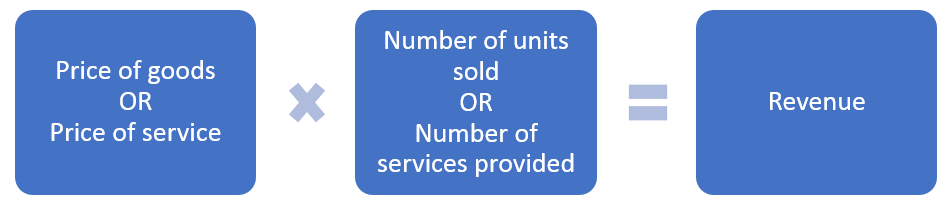

The Basic Revenue Equation

- Revenue (Sales) = The money generated by a company from normal business operations

- Revenue Accounts can be separate (ski equipment rental, lesson, lift ticket), or together (Intro package revenue)

Revenue-Related Source Documents

Revenue-Related Source Documents - Source Documents = capture key details of a business transaction

- Invoices = request for payment, also a source document

- Receipt = confirms payment for a good or service

- What if payment isn’t made immediately? (sale on account / sale on credit)

- Credit Terms = timeframe, discounts, late payment penalties

- Trade Credit = Discount for paying faster

- 2% discount for paying in 10 days, otherwise pay in 30 days = 2/10 net 30

4.2 | Introduction to revenue recognition

Recognizing Revenue when goods are sold (ASPE Criteria)

| ASPE revenue recognition criteria for goods: | Coffee sale meets criteria since: |

|---|---|

| The seller has transferred the significant risks and rewards of ownership to the buyer | The café has transferred the risks and rewards of ownership of the coffee once it is in your hand |

| Collection of payment is reasonably assured | Payment is assured since it is exchanged moments before or after you receive the coffee |

| The amount of consideration derived from the sale can be measured | The coffee you ordered has a set price |

| The agreed upon delivery of goods or provision of services under the contractual arrangement has been performed | Under the arrangement, the café was to provide you with coffee, which they satisfied once it was in your hand |

| R - risks and rewards have been transferred | |

| C - collection is reasonably assured | |

| M - measurable consideration (i.e., a set price) | |

| P - performance under arrangement has been completed |

Example: Sale of clothing would be recognized after it is picked up

Recognizing Revenue when services are sold (No R in RCMP)

| ASPE revenue recognition criteria for services: | Physiotherapy session meets criteria immediately after session since: |

|---|---|

| Collection of payment is reasonably assured | Payment is assured since it is made immediately following the session |

| The amount of consideration derived from the sale can be measured | The physiotherapy session has a set price of $100 |

| The agreed upon delivery of goods or provision of services under the contractual arrangement has been performed | Under the arrangement, the physiotherapist was to provide you with physiotherapy, which they satisfied once the session was over |

| Example: bike repair would be recognized after bike is ready for pick up |

4.3 | Revenue Recognition and customer payment timing

Customer Payment after Revenue is Recognized

- Example: After the clothing is picked up, we would debit Accounts Receivable (A/R)

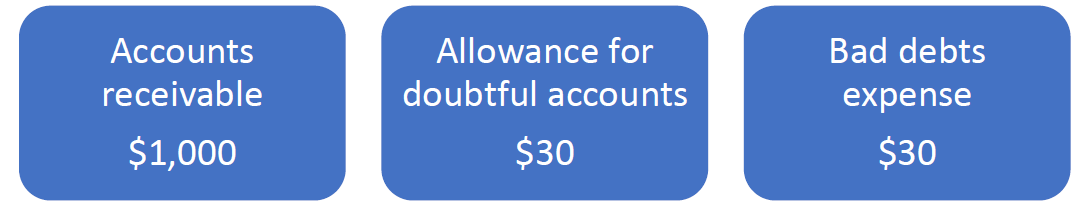

When Accounts Receivable Are Not Collected

- Allowance for Doubtful Accounts (AFDA) = Estimate of the percentage of accounts receivable that the business believes are uncollectible (contra asset account)

- Bad Debit Expense = estimate of uncollectable accounts receivable and accounts known to be uncollectable on the income statement

- Accounts Receivable Aging Report: Type of report showing how long individual A/R transactions have been outstanding

Illustrative Example

Illustrative Example

- Scenario 1: Albertson Inc. suffers financial fraud and cannot pay WSI at all

- Method 1: Setup AFDA then remove it by writing off the A/R

- Method 2: Book bad debts expense and write-off the A/R directly

- Scenario 2: Diamond Ltd. goes bankrupt and cannot pay their outstanding balance

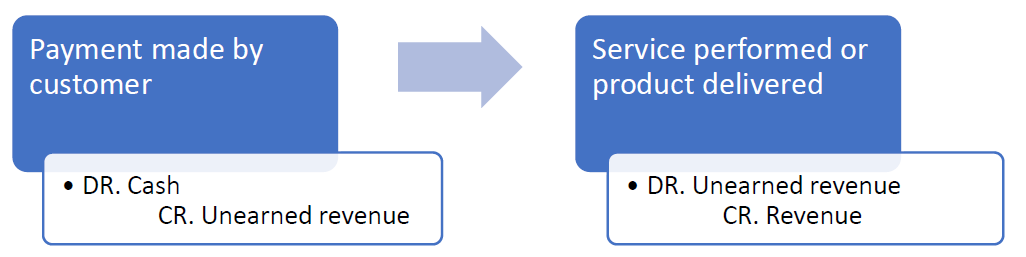

Customer Payment before Revenue is Recognized

- Unearned (deferred) revenue = money received for a product/service that has not yet been delivered

5 | Inventory Costing and Gross Margin Income Statement

5.1 | Accounting for Inventory Transactions

Inventory

- Merchandising business = company that purchases finished goods from a manufacturing business, then re-sells

- Inventory = asset account on balance sheet, holds the cost of merchandise before it’s re-sold

- Recognizing cost of merchandise as an expense: Cost of inventory goes out of the balance sheet and into the income statement as COGS

- Cost of goods sold (COGS) = expense on the income statement to recognize cost of inventory

| System | Definition | Inventory count | Examples |

|---|---|---|---|

| Perpetual inventory system | A system which uses computer software to keep track of goods bought, sold, and on hand | Inventory is manually counted at least once a year | Big name grocery stores, most large retailers |

| Periodic inventory system | A system which does not keep track of goods bought, sold and on hand | Inventory is manually counted several times a year | Small privately owned retailers |

Recording an Inventory Purchase Transaction

- Accounts payable = amount owed to suppliers for goods

- Purchase order = source document

DR. Inventory (A) XX

To record an inventory purchase with cash.

DR. Inventory (A) XX

To record an inventory purchase on account.

DR. Accounts payable (L) XX

To record payment for an inventory purchase on account.

Recording a Sale of Inventory Transaction

DR. Accounts Receivable / Cash (A) XX

To record the sale of merchandise as revenue.

DR. Cost of goods sold (E) XX

To record the cost of merchandise sold as an expense (in the same period in which revenue is recognized).

| Costing Method | Definition | ASPE Guidance | Examples |

|---|---|---|---|

| Specific identification method | An inventory costing method used to measure COGS, where each item in inventory is identified and tracked | Required for inventory that is not interchangeable. Also required for inventory used for specific projects. | Building a custom luxury car, building a home, building an aircraft |

| First-in, first-out (FIFO) method | An inventory costing method used to measure COGS, where it is assumed that inventory purchased or produced first (first-in) is sold first (first-out) | Appropriate to use for inventory that is interchangeable. | Clothing stores, grocery stores |

| Weighted average cost method | An inventory costing method used to measure COGS, where the weighted average cost of inventory is assumed to be the cost of inventory sold | Appropriate to use for inventory that is interchangeable. | Clothing stores, grocery stores |

| FIFO Method |

- Cost of goods sold in July for men’s jeans

- Prepare the cost of goods sold journal entry for

5.2 | Preparing a Gross Margin Income Statement

Product vs Period Costs

- Product costs = all costs related to purchasing or producing a good (on balance sheet)

- Period costs = other costs, either operating expenses or non-operating (not on balance sheet)

Operating Expenses (OPEX) / Selling, General, and Administrative (SG&A

- Research and Development (R&D) costs

- Selling and Marketing (S&M) costs

- General and Administrative (G&A) costs

- Employee wages

- Rent

- Depreciation

- Legal and professional fees

- Other operating expenses (utilities, office supplies, …)

Non-operating expenses

- Financing costs (interest)

- Income taxes

Gross Margin Income Statement

Solving for COGS

| Profitability metric | Definition | Ratio | Purpose |

|---|---|---|---|

| Gross margin percentage | The difference between revenue (price paid by a customer) and cost of good sold (cost to purchase or produce a good) | Gross margin ÷ Revenue | Demonstrates how effective a company is at generating a profit after recognizing product costs (costs to purchase or produce a good) |

| EBIT (or operating income) percentage | Represents the amount of profit a company generates strictly from its operations, which can be calculated in two different ways—deducting operating expenses from gross margin (Chapter 5) or deducting fixed costs from contribution margin (Chapter 6) | EBIT ÷ Revenue | Demonstrates how effective a company is at generating a profit from its operations |

| Net income percentage | The difference between EBIT and non-operating expenses | Net income ÷ Revenue | Demonstrates how effective a company is at generating a profit after recognizing all expenses. |

Direct and Indirect Costs

- Cost object = Gets a cost assigned to it

- Direct costs = Costs can easily be traced to a cost object

- Indirect costs = Costs cannot be easily traced

| Cost object | Direct costs | Indirect costs |

|---|---|---|

| Product (e.g., a good, like a t-shirt) | Direct materials that can easily be traced to a product or good (e.g., the cotton used to make the shirt) Direct labour that can easily be traced to a product or good (e.g., staff operating machinery to make the shirt) | Indirect materials that cannot easily be traced to a product or good (e.g., water used to wash all raw materials the company uses to produce its products) Indirect labour that cannot easily be traced to a product or good (e.g., security staff that patrols all company buildings including the factory and corporate office) |

| Cost Flows For Manufacturing Companies |

- Manufacturing Businesses = companies which produce finished goods

- Examples of product costs

- Direct materials

- Direct labour

- Manufacturing overhead (indirect materials, indirect labour, other indirect factory costs)

- Manufacturing companies have 3 inventory general ledger accounts

- Raw materials inventory

- Work in progress inventory

- Finished goods inventory

Cost of Sales for Service Companies

- Service businesses = companies which provide a servvice

- Cost of Sales (COS) = costs related to providing a service

- Direct materials

- Direct labour

- Direct travel

- Depreciation of long-term assets

| Service Business | Examples of costs that can be included in COS |

|---|---|

| Hair salon | - Direct materials such as hair gel or hairspray - Wages of hair stylists |

| Consulting | - Wages of consultants - Consultant travel costs - Depreciation of long-term assets (e.g., consultant’s computer) |

| Gym | - Wages of trainers, class leaders/teachers - Direct materials such as cleaning wipes - Depreciation of long-term assets (e.g., gym equipment) |

6 | Contribution Margin Income Statement

6.1 | Components of Contribution Margin

| Categorization | Formula | Purpose |

|---|---|---|

| Product and period costs | Total operating costs = Product costs + Period costs | Prepare gross margin income statement for internal and external stakeholders |

| Variable and fixed costs | Total operating costs = Variable costs + Fixed costs | Prepare contribution margin income statements for internal stakeholders |

| Direct and indirect costs | Total operating costs = Direct costs + Indirect costs | Prepare segmented income statements for internal stakeholders |

| Variable Costs: Costs that vary |

- eg. gas expenses that depend on delivery which depends on sales Fixed Costs: Constant

- eg. property costs Relevant Range: Span of activity within which assumptions hold true

- eg. Fixed total costs will increase if X items are sold Mixed Costs: Combine variable and fixed costs

- Delivery truck: Insurance is fixed, gas is variable

6.2 | Analyzing Mixed Costs

= total mixed cost = variable cost per unit / slope = units of activity = total fixed cost / y-intercept

High-Low Method: Separating fixed and variable cost by comparing total cost at highest vs lowest level (also called a cost model)

- Identify periods of highest and lowest activity

- Calculate slope of variable cost (a)

- Plug into equation, solve for (b)

- Present formula

6.3 | Preparing the Contribution Margin Income Statement

Contribution Margin: Difference between revenue and variable costs

Contribution Margin Ratio: Percentage of sales left over to cover fixed costs

Gross Margin Income Statement (GM) = for external stakeholders, includes COGS Contribution Margin Income Statement (CM) = for internal stakeholders

6.4 | Cost Structures

High Capital Companies have high fixed costs, low variable costs Low Capital companies have low fixed costs, high variable costs

7 | Cost-Volume Profit (CVP) Analysis

7.1 | Cost-Volume Profit Analysis

Interpreting a Contribution Margin Income Statement

Applications of Cost-Volume Profit Analysis

- Incremental Analysis: tool that only considers items that change (eg. revenue, costs) when a decision is made

- Proceed if OPEX UP

- Do not proceed if OPEX DOWN

Changes in Fixed Expenses and Sales Volume

- Solution 1: Contribution Margin Approach

- Solution 2: Incremental Analysis Approach

Changes in Variable Expenses and Sales Volume

Changes in Sales Price / Volume and Fixed Expenses

Changes in Variable Expenses, Fixed Expenses, and Sales Volume

- Use Incremental Analysis Approach

7.2 | Break-even and margin of safety

Break-Even Point: The point at which you break even :o Margin of Safety: Total actual sales dollars - Break-even sales dollars (like a safety cushion)

For a Single-Product Company

For a Multi-Product Company

- Sales Mix: Percentage of total sales dollars generated by each product

8 | Retained Earnings & Assets

8.1 | Understanding retained earnings

Retained Earnings = cumulative amount of net income let over after dividends were paid to shareholders

- If retained earnings on balance sheet is wrong, then closing retained earnings on statement of retained earnings is wrong

- If depreciation expense was wrong, then income statement, statement of retained earnings, and balance sheet are wrong Accumulated deficit = cumulative losses over time

8.2 | Current assets

Liquidity = Ease or speed at which assets can be converted into cash Current Assets = those expected to be used or received in 1 year (liquid) Long-term Assets = expected to be used in longer than 1 year (illiquid)

Cash Equivalents = Highly liquid short-term investments, low fluctuation

- Treasury bills: short-term government bonds

- Money market funds: highly liquid, short-term mutual fund

- Commercial paper: short-term debt issued by corporations

Short-term investments = investments that mature or are sold within 3-12 months

- Government bonds (GICs) = government debt with the least risk

- Corporate bonds = debt issued by corporations

- Certificates of deposit = like a bank savings account, but with fixed maturity date and interest rate

Notes receivable = written promise to receive money in >90 days with interest

- Creditor = issuer of note

- Maturity date = when the principal is due

Prepaid expenses = aka “prepaids”, are expenses paid in advance (eg. rent, insurance)

8.3 | Long-term assets

| Fixed asset type | Examples |

|---|---|

| Tangible assets | - Land - Buildings - Factories - Equipment - Machinery - Vehicles - Furniture |

| Intangible assets | - Patents - Trademarks - Customer lists - Licenses - Copyrights - Software |

Fair Value = the fair market value of an asset Impairment = state of an asset where its carrying value (on balance sheet) > fair value

| Type of intangible | Description |

|---|---|

| Patent | An exclusive right granted by the federal government to produce and sell an invention (e.g., a patent to protect exclusive sale of Tylenol) |

| Trademark | Sometimes referred to as trade name or brand name, it represents a unique/distinguishing combination of letters, words, images, sounds, and designs that is recognizable in the marketplace (e.g., the Nike swoosh) |

| Customer list | Valuable information about customers, including contact information, demographics, and even buying habits that can increase the effectiveness of a company’s sales and marketing efforts |

| License | The right granted by a government or business to sell a specific product or service (e.g., a taxi license allowing the holder to operate a taxi service) |

| Copyright | An exclusive right to produce or reproduce various creative works such as literature, art, and music (e.g., a copyright protecting the original artist from an unauthorized reproduction of their song) |

| Return on assets (ROA) = metric of how effective a company’s assets are in generating net income |

9 | Liabilities & Equity

9.1 | Current liabilities

Understanding Current Liabilities

- Liabilities = If a company incurs a liability, it has a legal obligation to repay the creditor (cash, services, etc)

- Liability characteristics:

- 1: Duty / responsibility that requires settlement in the future

- 2: Entity has little / no discretion to avoid settling the obligation

- 3: Transaction of events that results in obligation has already occurred

- Current liabilities = paid off in <1 year

- Long-term liabilities = paid off in >1 year

- Contingencies = situations that might trigger an obligation in the future (eg. a lawsuit)

Current Liabilities

- Short-term borrowings / debt = amounts owed

- Line of credit = like a loan, with no maturity date

- Accounts payable = amounts owing for payments made on account

- Accrued liabilities = expenses the business has incurred but not paid for yet

- Notes payable = written promise to pay an amount to another party (typically in > 90 days)

- Unearned revenue = obligation to perform work in the near future

- Current portion of long-term debt = debt due < 1 year

9.2 | Long-term liabilities

Long-term debt = Money due > 1 year

- Bank loan = money borrowed from bank, can be defaulted on

- Bonds = loans issued by public companies

- Mortgages = loans secured by property (land, buildings). Larger ones require collateral

Other Long-term Liabilities

- Leases = rental agreement where payment is exchanged for the right to use an asset

- Lessee (paying money) and lessor (giving asset)

- What qualifies as a capital lease? ANY of the criteria

- Ownership is transferred to the lessee at the end of the least term

- Lessee has the option to purchase the asset for an amount < fair market value

- Lease term is >75% of asset’s expected useful life

- Present value of lease payments is >90% of fair market value of asset

- Post-employment benefits = pension, medical insurance, life insurance, etc.

| Type of lease | Definition | Examples | Accounting Treatment |

|---|---|---|---|

| Operating lease | Substantially all the risks and rewards of ownership remain with the lessor | Leasing office space from Brookfield Properties, leasing photocopiers from Xerox | The lessee accounts for the lease payments as rent expense on the income statement; an asset or a liability are not recorded on the balance sheet |

| Capital lease | Substantially all the risks and rewards of ownership are transferred to the lessee, even though formal legal title remains with the lessor | Leasing airplanes from Boeing, leasing a vehicle for a salesperson from BMW | The lessee accounts for the lease as an asset and a corresponding lease liability on the balance sheet; depreciation expense is recorded on the income statement (and accumulated on the balance sheet), similar to a long-term asset like PP&E, while interest expense, corresponding to the liability, is recorded on the income statement. |

9.3 | Shareholder’s equity

Terminology

- Shareholder’s equity: used when there is one shareholder/owner

- Shareholders’ equity: used when there are multiple shareholders/owners

- Owner’s equity: an alternate acceptable terminology used when there is one shareholder/owner

- Owners’ equity: an alternate acceptable terminology used when there are multiple shareholders/owners

Other balance sheet components

- Share capital: the money a company raised from investors buying common / preferred shares

- Contributed surplus (paid-in capital): amounts paid in by equity holders, usually representing a premium paid on purchased shares.

- Non-controlling interests (NCI): equity in a subsidiary that’s not attributable to the parent company

| Share type | Description |

|---|---|

| Common shares | The most basic form of equity ownership in a company. Every corporation issues common shares, which entitle the shareholder to four rights: selling those shares, voting, receiving dividends, and residual assets upon liquidation. |

| Preferred shares | A more specialized form of equity ownership that is not necessarily issued by every company. They have the same rights as common shares except voting. Additionally, they have the advantages of earning a fixed dividend which is received before common shareholders and they receive assets before common shareholders upon liquidation. |

| Only common shares |

Common and preferred shares

Return on Equity (ROE) = Shows how effectively a company uses equity to generate income

10 | Cash Flow Statement

10.1 | Overview of cash flows

Importance of cash flows

- Internal stakeholders monitor to understand if / when the company needs cash from investors / banks

- Management monitors operating activities and assesses if they’re sufficient to cover investing (eg. purchasing new equipment) and financing (eg. repaying a short term loan)

- External stakeholders also analyze it to determine a company’s ability to pay dividends and grow in the future

- Banks analyze it to assess if the company can make interest / debt payments

Operating / Investing / Financing Activities

| Type of activity | Definition | Examples |

|---|---|---|

| Operating activities | Activities related to operating the core business. | Cash received from customers for selling goods or delivering a service during a period. Cash used to pay suppliers and employees. |

| Investing activities | Business activities related to purchasing or disposing of long-term assets and investments that are not cash equivalents or held for trading. Activities related to making cash advances and loans to other parties are also investing activities. | Cash used to purchase new equipment or software. Cash used to expand a manufacturing facility. Cash received from disposing (i.e., selling) used equipment. Cash used to lend money to another party. |

| Financing activities | Business activities related to raising capital. | Borrowed cash received from a bank. Cash used to repay a bank loan. Cash received from an investor in exchange for company shares. Cash used to pay dividends to shareholders. Cash used to buy back shares. |

| ASPE requires the following classifications in the cash flow statement: |

- Cash flows from interest paid and received which are included in net income should be classified as cash flows from operating activities.

- Cash flows from income taxes should be classified as cash flows from operating activities.

- Cash flows from dividends paid are charged to retained earnings and should be classified as cash flows used in financing activities.

10.2 | Preparing a cash flow statement

Information

- Income statement for the period (to obtain net income, depreciation, etc.)

- Statement of retained earnings (to obtain dividends paid)

- Balance sheet for the most recent and prior period (to adjust net income for non-cash working capital transactions and investing and financing activities)

- Other financial information, as required

Cash Flow Statement

- Prepared for specific period: month, quarter, or year

- To understand how cash is generated and used during a period

Cash flow from / used in operating activities

- Direct method: Inflows - Outflows

- Indirect: Uses accrual net income

There are three main categories of adjustments that are made to net income:

- Non-cash items

- Add depreciation/amortization to net income

- Add losses on long-term asset disposals to net income

- Remove gains on long-term asset disposals from net income

- Changes in current assets (other than cash) - A/R, Inventory, Prepaids

4. Remove increases in current assets from net income

5. Add decreases in current assets to net income - Changes in current liabilities - A/P, Accrued Liabilities, Unearned Revenue

- Add increases in current liabilities to net income

- Remove decreases in current liabilities from net income

Cash Flows from/used in Investing Activities

- Inflows: Cash received from:

- Disposing of a long-term asset (e.g., intangible, PP&E)

- Sale of investments (excluding cash equivalents or investments held for trading)

- Collection of advances and loans

- Outflows: Cash used in:

- Purchasing new equipment or intangible asset

- Purchasing a new store

- Purchasing investments (excluding cash equivalents or investments held for trading)

- Advances and loans made to other parties

Cash Flows from/used in Financing Activities

- Inflows: Cash received from:

- Borrowing (e.g., bonds, loans)

- Issuing equity (e.g., selling company shares)

- Outflows: Cash used in:

- Repaying debt (e.g., bonds, loans)

- Repurchasing equity (e.g., buying back shares)

- Paying dividends to shareholders

Completing the Cash Flow Statement

10.3 | Preparing a bank recollection

Bank Statement = document provided by bank to company to record all transactions Bank Reconciliation = document produced by company to reconcile bank statement with ending cash in G/L

- Bank side (start with the bank statement balance), and

- Book side (start with the general ledger ending cash balance).

Adjusted bank balance = correct cash balance after reconciliation

- Deposits in transit - company deposited cash at bank, recorded it, bank hasn’t processed yet

- Outstanding Cheques - cheques issued by company, recorded, bank didn’t clear yet

Adjusted book balance = same thing

- Bank collections = customers paid for goods/services, bank recorded, company hasn’t

- Electronic Funds Transfers (EFTs) - bank processed payments, company hasn’t

- Service charges - bank fees charged to company, not recorded yet

- Interest income - company earned interest, not recorded yet

11 | Preparing External Financial Statements and Internal Reports

11.1 | Internal and External Reports

| Reporting for Internal Stakeholders | Reporting for External Stakeholders | |

|---|---|---|

| Stakeholders | Executive teams (e.g., CEO, CFO, etc.) Management teams Private investors Board of Directors | Public investors (e.g., shareholders) Lending institutions (e.g., banks) Government and regulatory bodies |

| Accounting Standards | Does not need to follow generally accepted accounting standards (e.g., ASPE or IFRS) | Must follow generally accepted accounting standards (e.g., ASPE or IFRS) |

| Level of Detail | Detailed reporting and in-depth analysis to support internal decision-making AND summary data with relatively less detail | Summary data with relatively less detail |

| Frequency | Monthly, quarterly, and yearly | Typically quarterly and yearly, but can be more frequent if requested by an important external party |

| Comparisons | Actual results vs. budget and/or forecast Actual results vs. prior year | Actual results vs. prior period |