0. Microeconomics Curriculum

- Basic Economics

- Supply / Demand

- Production / Cost

- Imperfect Competition / Games

- Factor Markets

- Government

1. Basic Economic Concepts

1.1 Scarcity

1.2 Opportunity Cost and the PPC

1.3 Comparative Advantage and Trade

1.4 Demand

- T - Tastes and preferences

- R - Related goods and services

- I - Income of consumers

- B - Buyers

- E - Expectations of the future

1.5 Supply

- I - Input prices

- N - Number of suppliers

- E - Expectations of future

- R - Related products

- T - Technology

1.6 Market Equilibrium

Elasticity

- S - Substitutes

- P - Proportion of income

- L - Luxury or necessity

- A - Addictive

- T - Time

2. Economic Indicators and the Business Cycle

Circular Flow

![]()

GDP

Income = Expenditures = Value Added

- GDP = Aggregate Demand

- Y = Income

- C = Consumption Expenditure = household spending on goods/services

- I = Investment Expenditure = firms buying stuff (capital - machines, factories), or increasing stock (making computers)

- G = Government Spending = government spending on goods/services (eg. infrastructure, paying employees, NOT welfare → that’s transfer payments)

- X = Exports

- M = Imports

Restrictions of GDP

- Volunteer work (charity, stay at home)

- Inequality

- Negative things (repairs, weapons)

Output Gap = Actual - Potential GDP

Unemployment

Employed = number of people currently employed (part + full time) Unemployed = number of people looking for work but not employed Underemployed = number of part time people that would rather work full time, or people with jobs that don’t make full use of their qualifications

- Low = 5%, High = 8%

Labor force = Employed + Unemployed Labor force participation rate: People not seeking work

- Excludes children

- retirees

- adult students

- those who can’t work (illness or disability)

- those who don’t want to work

- those who have given up looking for work (discouraged)

Employment rate excludes:

- Discouraged workers

- Marginally attached workers (eg. taking time off)

Types of unemployment:

- Structural Unemployment: Economic restructuring making skills obsolete, Oversaturated labour market, Change in geographic location of industries

- Frictional Unemployment: Unemployment caused by new entrants into the job market and people quitting a job to find another

- Seasonal Unemployment: Unemployment caused by seasonal work

- Cyclical (demand deficient) unemployment: Unemployment caused by the business cycle

Natural Rate of Unemployment

- Natural rate: Normal rate

- Above natural rate during growth

- Below natural rate during recession

- Cyclical Unemployment: Deviation from the natural rate

- Change in labour force characteristics

- Changes in labour market institutions

- Changes in government policy

The Business Trade Cycle: Economic Fluctuations

Economic Fluctuations = tied to success of agriculture and stuff

Inflation

CPI = Consumer Price Index = Price of a basket of goods

- Inflation: CPI up

- Deflation: CPI down

- Disinflation: Inflation concave down

- Hyperinflation: Inflation concave up

- Stagflation: Recession + Inflation

Phases of the Business Cycle

Phases of the Business Cycle - Expansion = when there is positive growth in real GDP

- Employment rises, prices rise

- Peak = the cycle’s max level of real GDP marks the end of an expansion

- Unemployment falls, prices rise

- Contraction = After peak, there’s falling real GDP (negative growth)

- Recession = 2 quarters of contraction

- Depression = long recession

- Trough = After contraction, expansion again

3. National Income and Price Determination

Fiscal Policy

Fiscal Policy = when legislature does stuff Monetary Policy = when central banks do stuff

- To encourage or discourage growth

Policy Rate = Central Bank Rates Prime Rate = Rate for Bank’s best customers Bank Lending Rate = Rate between banks

Shocks and smoothing

Shocks = unexpected event that change GDP

- Good/bad fortune that strike households

- Self-insurance = save and borrow

- Co-insurance = support from social network / governments

- This means that households prefer to smooth their consumption (save/borrow) and that they are altruistic

- Good/bad fortune that strike economies

- Co-insurance becomes less effective, but is still necessary

- People used to practice trust, reciprocity, and altruism

Smoothing Consumption = making consumption plans based on expectations of the future

- Readjust long-run consumption if permanent shock

- Don’t if temporary

Consumption smoothing on a macro scale

- Stabilization

- Limits: Credit constraints, weakness of will, limited co-insurance

- Credit constraints = limit on ability to borrow

- Weakness of will = no passion

- Limited co-insurance = less altruism

Government size vs GDP

- As governments get bigger, GDP stabilizes and is less susceptible to shocks

Sticky = nominal price is resistant to change → moving up / down curve Automatic Stabilizer = Counteracts the business cycle without any government policy (unemployment, welfare)

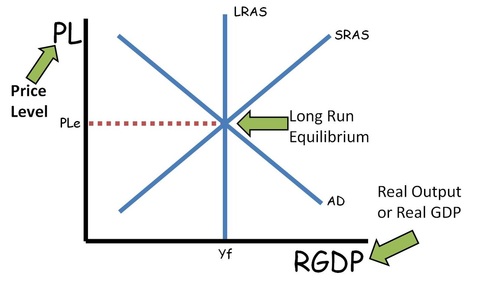

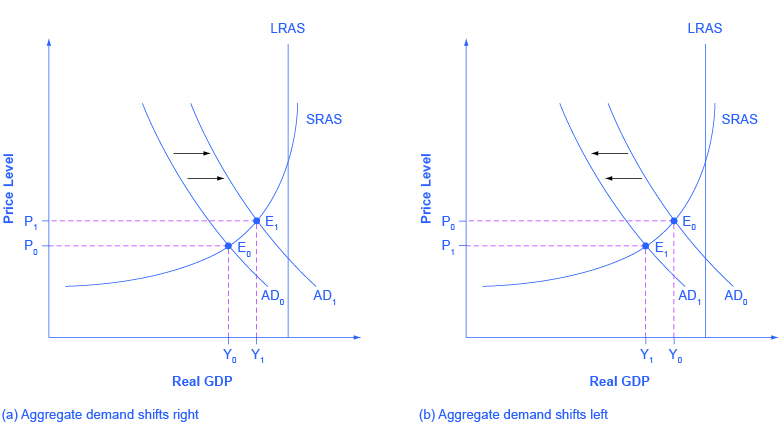

AD-AS Model

Consumption Function

Aggregate Consumption has:

- Autonomous Consumption (how much you will spend anyway)

- Consumption dependent on income

- Aggregate Demand (AD) = consumption function + investment

- Investment is independent of consumption

- Slope <45 deg

- 45 deg line is when Y = AD

Slope of consumption function = marginal propensity to consume

- Poor households with credit constraints have large MPC

- Wealthy households have small MPC

- Expectations of the future are reflected in autonomous consumption

Shifts in AC (Aggregate Consumption) function

- Changes in expected future

- Disposable income

- Changes in aggregate wealth (eg. stock market UP, recession DOWN)

Assumptions about the spending multiplier

- Producers are willing to supply additional outputs at a fixed price

- 1k more goods

- Given interest rate

- Just looking at C and I

Spending increases by $100b

- Aggregate output increases but $100b

- Multiplier Effect: Some of the $100b goes to people, which goes to firms, which goes to people (multiple rounds of spending)

MPC and MPS

- Higher for richer people

Total increase in real GDP =

(1+MPC+MPC^2+MPC^3+\ldots)*$100bThe Multiplier and the Great Depression

- most economists thought 1929-33 was a collapse in investment spending

- but as economy shrank, it also fell, multiplying the effect on real GDP

- our taxes and spending > 1929

- taxes and spending are stabilizers

John Maynard Keynes (Keynesian economics)

- Untangled the Depression and the multiplier effect

- Tax more + spend less when times are good, tax less + spend more when times are bad

Household Wealth

- broad wealth = broad assets - debt

- target wealth = aim

- precautionary saving = more saving

- fall in expected earnings ⇒ precautionary savings

Changes in house prices

- change household wealth (home equity)

- change in credit constraints (harder to borrow)

- You pay capital gains tax on a house that isn’t your primary residence (house flipping)

Investment: Aggregate investment function (like aggregate consumption)

4. Financial Sector

Financial Assets

- Stocks = investment into company

- Bonds = investment into government

- Equity = Value - Debts

- Liquidity: House < Bonds < Savings account < Cash

What is money?

- Financial asset to purchase gods / services

- Currency in Circulation: held by the public

- Checkable in bank accounts: demand deposits

- Money Supply: total of financial assets

- M1 = Public currency and coins, checkable deposits, checks

- M2 = M1 + Savings deposits, small time deposits, shares in mutual funds

Purpose of money (requires trust)

- A medium of exchange

- A store of value

- A unit of account

- Allows purchasing power to be transferred

- Gershan’s Law: “bad money drives out good” - metallic vs paper money, fiat money

Income (money) vs Wealth (capital)

- Net income = gross income - depreciation

- Earnings = income from labour

- Saving = income not consumed

- Investment = expenditure on capital goods

Banking

Mutual Gain

- People spend time by browsing / investing / lending / saving

- Conflict of interest between borrowers and lenders over interest rate

- Principle-agent relationship - lender (principle) cannot guarantee borrower (agent) pays back

- Lenders often require borrowers to contribute their own funds *collateral)

- This means that poor people can’t get money (credit constrained / excluded)

- Bank account needs address → can’t get paid → Money Mart / microfinancing

- Gini Coefficient is a measure of inequality

How banks create money

- Lend money to other people who deposit to other banks

- Reserve Ratio: how much you have to keep

- Excess Reserves: 90% of total reserves

- Money Multiplier =

- Broad money = base money + bank money

Risk

- Banks provide maturity transformation (after period of time)

- They also provide liquidity transformation because loans are frozen (illiquid)

- Default Risk

- Liquidity risk

- Bank run:

- Everyone asks for money

- Bank makes bad investments

Banking Business

- Cost = Operational, Interest

- Revenue = Interest, repayment (they want you to invest)

- Expected return = return on loans * default risk (99%, 80%, …)

- Mortgages > normal loans because no default risk

- Balance Sheets = Equity = Net Worth = Assets - Liabilities

- If Net Worth < 0 , the bank is insolvent / bankrupt

- Most common debt is consumer debt (credit card debt)

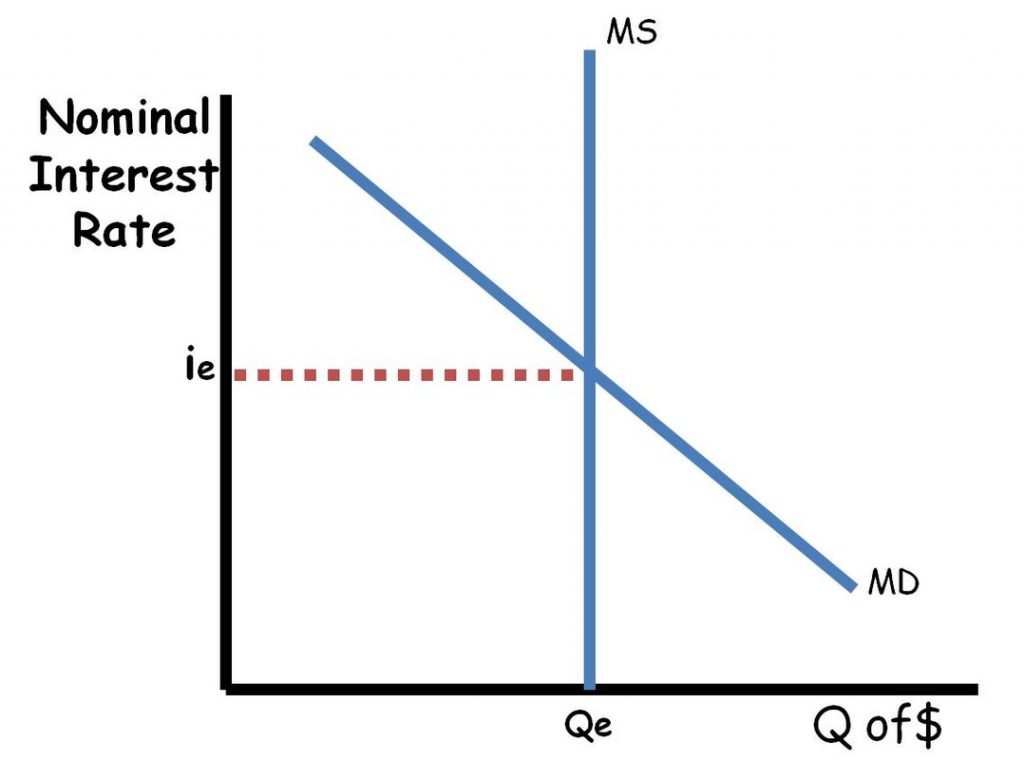

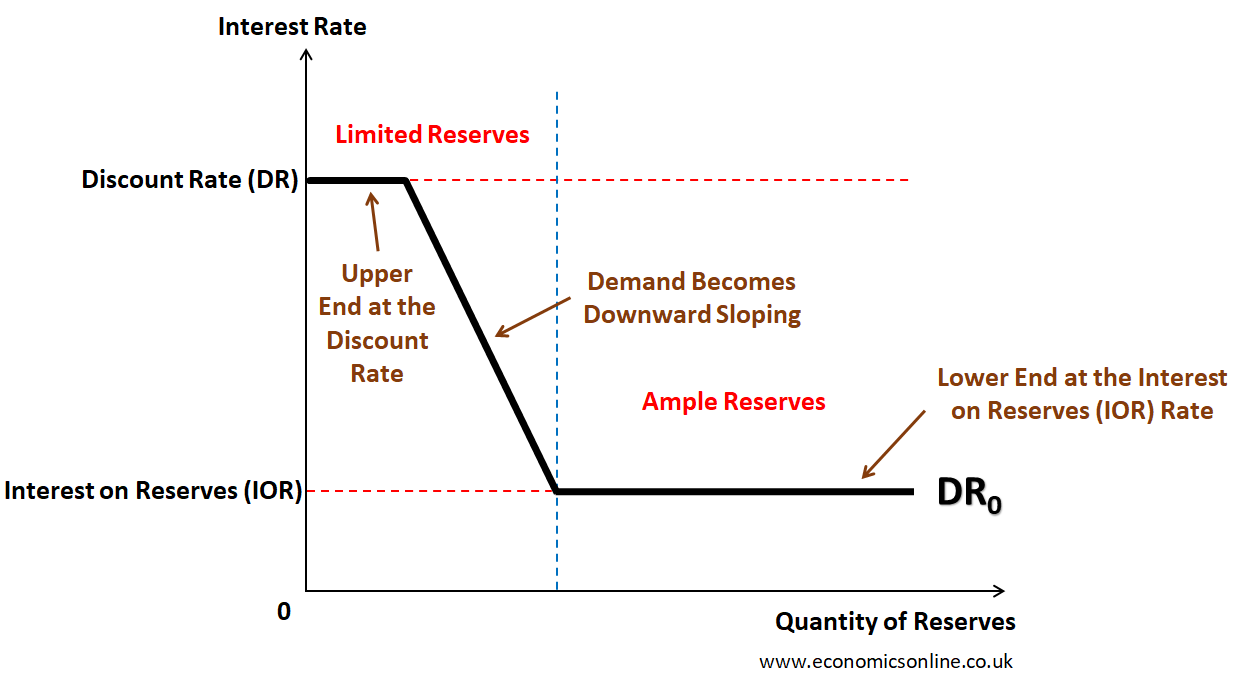

Money Market

- Banks borrow from each other / central banks at a short term interest rate

- Policy Interest rate: Set by Fed

- Bank lending rate: average interest rate charged by banks to households

- Prime Rate: Rates for best customers

- Fixed vs Variable (prime, prime+1)

Monetary Policy

- To Increase , the Bank of Canada buy bonds from the market

- To decrease , they sell bonds

- Higher interest = Reduced AD = Lower inflation = higher unemployment

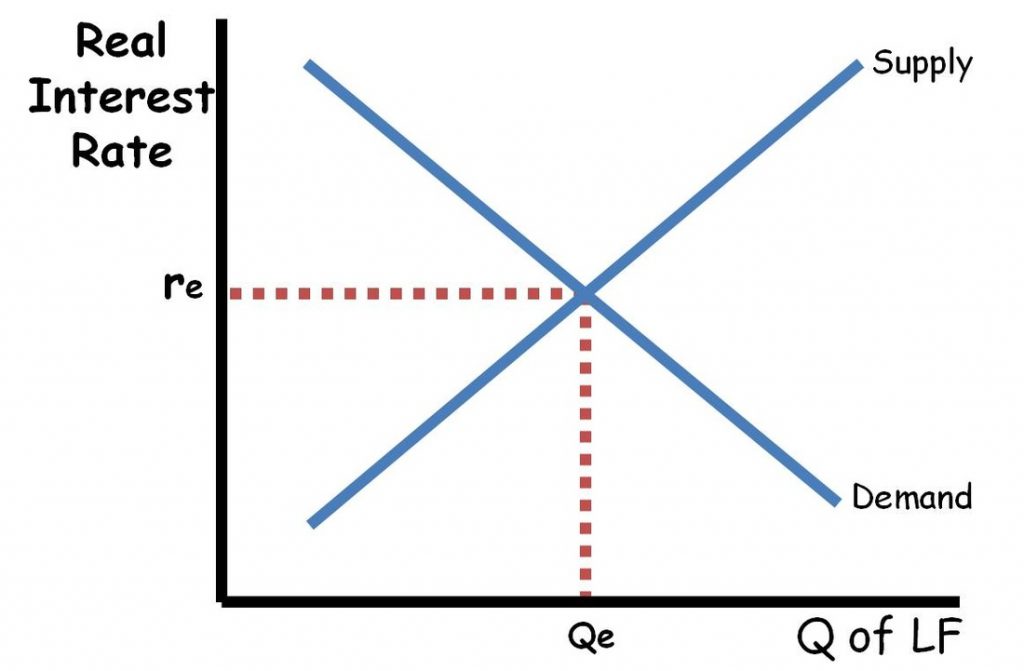

Loanable Funds Market

What’s being bought and sold is money that has been saved

What’s being bought and sold is money that has been saved

- Borrowers demand loanable funds

- Savers supply loanable funds

- When governments borrow, supply decreases

5. Stabilization Policy

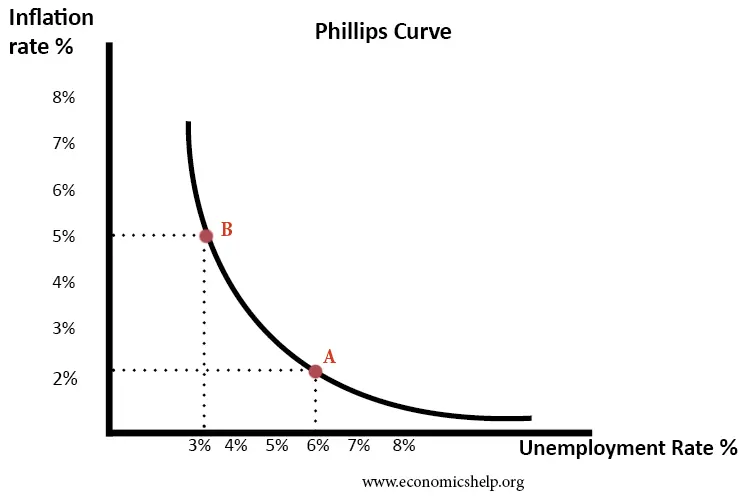

The Phillips Curve

Inflation and Unemployment are inversely proportional

Money Growth and Inflation

Velocity of Money

- P = price level

- T = aggregate real value of transactions

- M = total amount of money in circulation

Fiscal Policy

How Governments React to Economic Fluctuation

- Government size (spending on health/education, higher tax rates which reduce the multiplier → smaller growth = smaller crash)

- Unemployment benefits (also pension plans)

- Intervention (fiscal policy)

Long-run

- ”we’re all dead”- Keynes

- The economy is self correcting (growth w/o government intervention)

- People will acclimatize to having less and doing more (eg. Black Plague)

- Stabilization policy to reduce the severity of recessions

Macro Policy

- Demand Shocks

- If policy could perfectly anticipate shifts of the AD curve

- Price stability is good (Inflation in 70s-80s was high, 2010s was good, 2020s bad)

- Supply Shocks

- Much harder

- If people are willing to work for lower wages → Input prices go down → Supply shifts right → Aggregate Supply shifts right

- Unemployment vs Inflation

- Lower unemployment = higher inflation

Taxes and Government Spending

- Funds → Government through taxes and government borrowing

- Funds ← Government through purchases of goods/services, transfers

- When spending increases and taxes are cut, economy expands

- Trickle Down Economics

- Fiscal policy shifts the Demand curve

Expansionary and Contractionary Fiscal Policy

- This can eliminate an inflationary gap Expansionary (increasing AD)

- Increases in gov’t purchases of goods and services

- cut in taxes

- increases in gov’t transfers

Contractionary (decreasing AD)

- reduction spending

- more taxes

- reduction transfers

Problem: Lags in Fiscal Policy Time Sinks:

- Realizing the recession / inflationary gap + analyzing data

- Government developing a spending plan

- Implementing the plan

Multiplier Effect

- Changes in taxes, transfers, government spending

- Multiplier effect: Increase in real GDP > initial reduction in aggregate spending

- Spending Multiplier

- Tax Multiplier

- There is no **first round of spending ** / the initial injection isn’t all spent

- Changes in government purchases > changes in taxes / transfers

Balanced Budget Multiplier

- Government increases taxes to cover spending

- Automatic Stabilizers: Progressive taxation, Healthcare, food stamps

- Discretionary fiscal policy: deliberate actions

Stabilizing

- Government spending (large and exogenous)

- Higher tax rate lowers the multiplier

- Unemployment insurance

- Deliberate intervention via fiscal policy

The paradox of thrift

- If a family is worried about falling wealth, they spend left

- With an entire economy, spending = income

- The aggregate attempt to increase savings leads to a fall in aggregate

- Fallacy of composition = what’s true for one part of the economy is not true of the whole

- Problem with the EU: if Greece has problems, the Euro is reliant on the ECB

- Fiscal policy becomes important

Fiscal Stimulus

- Budget Balance = T-G

- Budget Surplus is when Revenue > spending, Deficit is opposite

Government debt

- Debt to GDP ration is a good indicator of government success

- They can just roll back debt by selling new bonds

Reserves Market

6. International Trade and Finance

6.1 Balance of Payment Accounts

CA + CFA = 0

CA = Current Accounts (always balanced)

- Net exports (purchases or sale of goods)

- Money transfers (receiving money)

- Investment Income (overseas assets)

- Net unilateral income Net Exports = Trade Balance = Exports (credit) - imports (debit)

- Surplus / Deficit

CFA = Capital and Financial Account (not always balanced)

- Balance of payments for assets (purchases / sale of bonds)

- Financial capital transfers (physical assets, FDI) Financial capital going into an economy is a surplus (financial capital inflow)

Credit vs Debit

- Money in = Credit

- Money out = Debit

- Sum of Credit = Sum of Debit

6.2 Exchange Rates

Exchange Rate = The price of one currency in the terms of another

- Appreciation = more valuable

- Depreciation = less valuable

- When you buy something from another country, you use their currency

6.3 The Foreign Exchange Market

Foreign Exchange Market = Exchanging currency

- Demand for currency comes from demand for goods, services, financial assets

- Exchange rate is inversely proportional with quantity demanded

- Equilibrium = exchange rate and quantity demanded are equal

6.4 Effects of Policies and Conditions

Who participates in the market?

- Those looking to purchase international goods

- Those who want to earn income from another country

Determinants of currency demand:

- International Demand for goods and services

- International Demand for assets

- Fiscal / Monetary Policy

Determinants of Currency Supply

- Domestic demand for other country’s goods and services

- Domestic demand for other country’s goods assets

- Protectionist policies (tariffs, quotas)

6.5 Changes in the Foreign Exchange Market

Shifting AD → Net Exports = Export - Import

- Fluctuating currency values → changes relative price of goods

- Changes in the relative price of goods → changes next exports

- ex: US goods become more expensive to Canadians → US exports fall

6.6 Real Interest Rates and International Capital Flows

- Capital inflow: Supply shifts right

- Capital flight / outflow: Supply shifts left

Changes in interest rates:

- Monetary policy:

- Expansionary: decrease rates

- Contractionary: increase rates

- Demand for money:

- Increase: increase

- Decrease: decrease

- Budget Balance

- Deficit: increase

- Surplus: decrease

- Households saving

- Increase: decrease

- Decrease: increase

Financial Capital chases high interest rates

- Investors will gravitate towards higher returns (higher interest rates)

Practice Exam

- Economic growth = per capital real gross domestic product

- Reducing price level = decrease spending, increase interest rates

- Spending increase + Interest increase = interest increase + unchanged private investment

- Unanticipated increase in gov spending shifts LR Phillips Curve left (less unemployment)

- Crowding Out = private investment spending decreases b/c interest rates increase b/c government borrowing increases

- Anticipated expansion of MS increases nominal GDP and price

- Only selling to other countries increases current account surplus

- Decreasing taxes means higher nominal GDP

- To reduce unemployment, buy bonds to decrease interest rate and increase AD

- Central bank selling bonds to commercial banks decreases MS

- Current account deficit is financed by a surplus in financial (capital) amount

- Firm’s optimism about future income shifts AD right, increasing real output and price

- Balance = Deposits - Withdrawals

- tight monetary policy = higher interest and less private investment

- multiplier = 1/rr

- Recession caused by a decrease in AD

- More discouraged workers makes unemployment and labor force participation rate decrease

- Gov spending down and private saving up causes real interest down and interest-sensitive spending up

- Increased budget deficit = gov spending > tax revenue, and central bank increases MS

- CPI doesn’t fully measure inflation because improvement in quality of goods/services

- Demand-pull inflation increases real output, Cost-push inflation decreases it

- Buying bonds increases MS

- higher interest = lower inflation = higher employment